Hello and welcome to our July edition of the Premium Property Market Newsletter.

WHAT IS REALLY HAPPENING? WHOLE OF MARKET ANALYSIS

The graph opposite compares the first six months of 2024 with the second half of 2023, then with the first half of 2023 and also with the 6 year average of the same H1 period (Jan – June).

The first half of 2024 saw an increase in the number of properties listed for sale compared to the same period across the past six years and the second half of 2023.

There are several ways to look at this both positively and negatively.

The positives are that there is a better supply of property on the market and more choice for buyers, which was a real issue during the Covid market (July 2020 through to July 2022) as through that period there were not enough properties to keep up with demand. This extra supply will also bring those sellers to the market that wait until they have found a property to buy before listing their own property.

The negatives are that an increase in supply and more choice for buyers could cause prices to stagnate or reduce and mean it will take longer to sell a property as sellers have more competition.

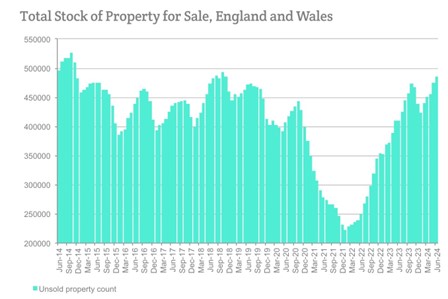

However, as you can see from the chart below, whilst stock levels of property for sale right now are considerably higher than that of late 2020 to late 2022, they are very similar to typical pre-Covid levels.

The number of new listings entering the market continues to be on the rise and this is a clear sign of increased positivity from sellers deciding now is the right time to make a move.

This positive sentiment is also being passed onto buyers with the number of sales being agreed outpacing the number of new listings when comparing the first half of 2024 with the first half of 2023 and the last six months of 2023.

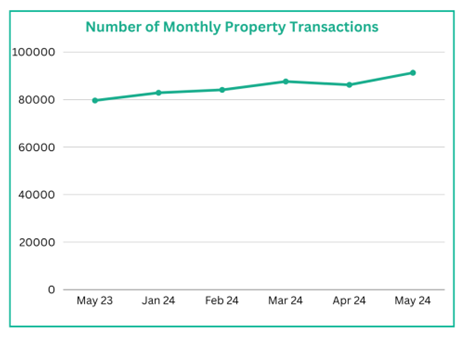

You can also see from this chart that transactions on the Land Registry continue to move in the right direction with a 17% increase on May 2023, a 2% increase on April 2024, and (bar April) there has been a six consecutive month-on-month rise.

Sales agreed in the first six months of 2024 are also 4.65% up on the six-year average which just goes to show that there is plenty of activity in the market.

Sales agreed in the first six months of 2024 are also 4.65% up on the six-year average and just goes to show that there is definitely plenty of activity in the market.

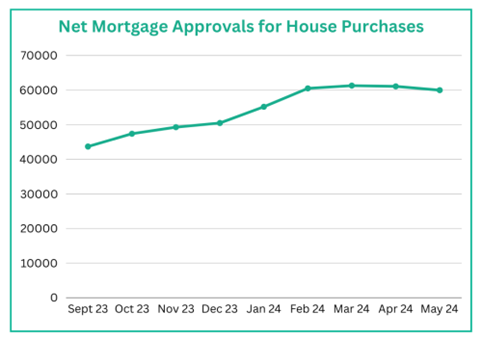

More sales being agreed has also meant an increase in the number of mortgage approvals as can be seen from this chart.

However, whilst there is growing activity in the market with an increase in the volume of properties coming to the market, more choice for buyers, and a higher number of sales being agreed, there is a continuing problem of incorrectly priced properties having to reduce their asking price.

In the first half of 2024, 42% of properties have had to reduce their asking price and 12.6% of all properties have had to reduce their asking price more than once.

According to Rightmove, properties that reduce their asking price are less likely to sell and if they do sell, will take 3 times longer to do so.

The latest Property Sentiment Index from OnTheMarket showed that 41% of properties are selling in the first month of coming to market and data from TwentyEA highlights that only 52.23% of properties coming to market are actually going on to sell.

We are clearly in a very price sensitive time and sellers must remember that buying power has reduced significantly over the past couple of years, whilst buyer demand is most definitely returning as buyer affordability continues to be stretched.

WHAT ABOUT THE IMPACT OF THE ELECTION?

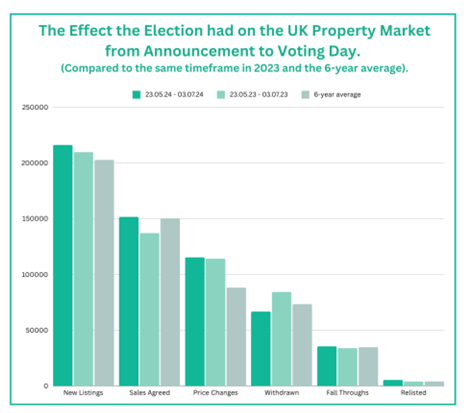

Now to review how the whole of the market reacted to the six-week campaign between the announcement of the election and the day of the Labour landslide victory.

As you can see from the chart:

- New listings are on the up.

- Sales are on the rise.

- Sellers are realigning their pricing expectations.

- Sellers are staying on the market and not withdrawing.

- Fall-throughs remained the same.

- More sellers are relisting their property.

The election has certainly not dampened the spirits of potential home movers and the market has responded positively.

Key statistics for the £1,000,000+ market across the UK from the first half of 2024 compared to previous years are as follows: –

1.There were 19.17% more properties newly listed to the market compared to the same period in 2023 and this was 42.28% higher than the six-year average for H1.

2.There was a 22.28% increase in the number of properties for sale in comparison to the same period in 2023. This figure was 38.47% higher than the six-year average for H1 as well.

3.The number of sales agreed rose by 17.29% when compared to the same period in 2023 and this was a 22.57% rise on the six-year average.

All of those metrics significantly outperformed the whole of the market and is strong evidence that the higher end of the market continues to remain very resilient against tougher market conditions with an increase in new listings entering the market, more properties for sale, and a higher number of sales being agreed.

However, there are still some other metrics to consider at the higher end of the market as well:

1.The number of price reductions compared to 2023 was 18.60% higher and 55.83% up on the six-year average.

2.There was an 11.28% increase on the number of properties withdrawing from the market when compared to 2023. This was also 31.45% higher than the six-year average.

3.The number of fall-throughs were 21.55% higher than the six-year average.

All of these figures were considerably higher than the rest of the market and highlights that whilst the premium end of the market is performing well, it is not immune to the difficulties impacting the whole of the market.

HOW WILL THE REST OF 2024 PLAY OUT?

There is a 60% chance of a cut to the base rate at the next meeting on 1st August.

Inflation has now dropped 4 months in a row and is at its lowest point since July 2021, hitting the 2% target that was aimed for.

All of this is a clear indication that the market is moving in the right direction.

So, if you or someone you know is thinking of making a move and hesitating to do so, there’s no one-size-fits-all answer to whether now is the right time to sell or buy a home.

There’s also no way to predict precisely what the market will do in the near future. Perfectly timing the market should not be the goal. This decision should be determined by personal needs, financial means, and the time one has to find the right home.

It is worth noting that those who have put off buying a home during recent times because they were holding out for prices to drop and lower mortgage rates, have been left out of the market.

Today’s price will always feel expensive, but remember we are now eight years on from the EU referendum and house prices are on average 32.17% higher than before the UK voted to leave the EU.

Some people might be sitting on the fence with what to do next now we have a new Government, but if the historic data is anything to go by, the UK property market will continue to remain resilient throughout evolving political and economic times. Many forecasts predict house price growth over the next few years.

Thanks for reading. If you or someone you know would like to better understand the value of their property, please don’t hesitate to get in touch with the team at Camden Chase Estate Agents.