HOW THE IS THE NEW LABOUR GOVERNMENTIMPACTING THE PROPERTY MARKET?

Hello and welcome to the second instalment of the Camden Chase Newsletter.

In this edition we will be reviewing what happened in the UK property market for the first full quarter (July – September) of a new government, comparing it to the previous quarter (April – June) and the same timeframe of recent years. We take a closer look at the local St. Albans property market and compare it to a wider national picture. Let’s dive straight in.

Nationally, there were 11% more properties for sale in Q3 2024 compared to the same time last year, this was also 19% higher than the six-year average for Q3. The number of properties currently for sale in England is at a 10-year high.

Locally, in the St. Albans area, there were 13.8% more properties for sale compared to Q3 2023, which is again, above the average of the last six years.

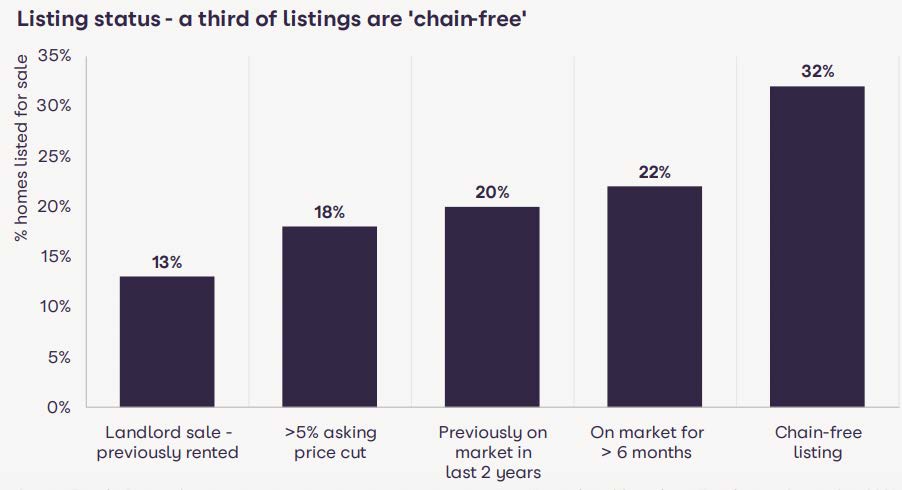

This increased level of choice for purchasers, and extra level of competition for sellers, would explain why Zoopla have found that 18% of properties that come to market are still reducing their asking price by at least 5% and why 22% of properties for sale, have been on the market for more than six months.

The Zoopla HPI also found a significant number of properties currently for sale that were previously rented out, or are being advertised with no chain. In St. Albans 25.2% of properties for sale have previously been rented and 45.4% of properties for are advertised with no chain.

In St. Albans, 67.6% of the properties for sale had a price reduction in Q3. Currently, 23.3% of properties that are for sale have been on the market for at least six months.

The latest Rightmove House Price Index (HPI) reports that it is currently taking, on average, a seller 60 days to find a buyer compared to 57 days at the same period last year. Specific to St Albans – the figure is 70 days.

The extra level of choice available to buyers has meant that only those sellers pricing correctly, and showing value for money, are managing to sell quickly. Value-conscious buyers can afford to take their time and wait for a property with less compromises or one that offers more bang for their buck, whilst mortgage rates creep down at the same time.

In Q3 2024, of the number of properties in St. Albans that left the market (were either sold or withdrawn) only 57.1% successfully found a buyer. This means that over 40% of homeowners coming to market are not going on to sell their property.

What we also noticed in the data for Q3 is a higher number of sales falling through compared to last quarter, relatively to Q3 last year, and the average sale fall through rates in recent years.

The data shows that the longer it takes a property to find a buyer, the more likely it is to fall-through. Properties that find a buyer in less than 25 days have a 6% chance of falling through, and properties that secure a buyer after 100 days have a 44% chance of falling through.

Rightmove have also highlighted properties that reduce their asking price take longer to sell and are twice as likely to have a sale fall-through.

If you would like to find out the “£ per square foot” value of your property and exactly where it sits in relation to comparable properties sold on the road and in the immediate area, CLICK THIS LINK to write a message to the team. Otherwise you can send us an email at hello@camdenchase.co.uk, call or WhatsApp us on 0330 043 4655.

THE CONCLUSION

There is more choice for buyers and higher competition for sellers, thus resulting in properties taking longer to sell and a higher number of price reductions taking place. More sales are falling through and more sellers are looking to change estate agents for a fresh approach, or they risk accruing time on market which has a big detrimental impact to the saleability of their property.

Pricing correctly from the outset, as always, is key to achieving a sale by making sure you are in the market as opposed to on top of it, where a seller will receive little to no interest. The other most important factors to successfully completing a sale, are presentation and promotion of the property. Today property promotion goes some way beyond Rightmove and Zoopla advertisement. Marketing strategies including posting video content to social media platforms like Facebook, Instagram and LinkedIn as well as YouTube help expose a property to the widest possible audience.

WHAT IS THE OUTLOOK FOR THE REST OF THE 2024 AND INTO 2025?

The number of new properties entering the market and sales being agreed suggests a more positive sentiment of where the market appears to be heading.

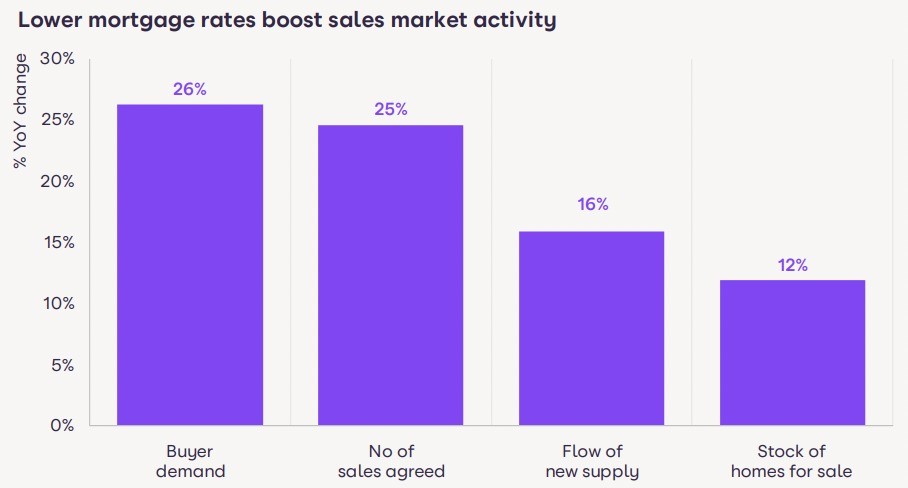

Nationally, the number of new listings entering the market in Q3 compared to last year was up 9% which is 3% higher than the the six-year average. Even more positively, the number of sales agreed in the quarter outstripped this at 23.7%, which is now at a level just 1% below the 6 year average.

This image from the Zoopla September House Price Index (HPI) also highlights the pent up buyer demand (Year on Year figures) following lower mortgage rates continuing to boost market activity through increased buyer confidence.

Mortgage approvals in August this year were up on the previous month of July, were 43% higher than August 2023, and are now sitting just 2% below the pre-pandemic average. Completed transaction numbers in August were up 5.4% on August 2023, but note they are still 9% below pre-pandemic levels.

The latest data from HM Land Registry has reported that prices are now 2.2% up on last this time year and are now higher than the peak of the market in September 2022.

The number of new sales being agreed (subject to contract) now sits just 1% below the six-year average, another strong indicator that we have returned to a more healthy market.

There are clear signs that confidence is returning to the market and whilst there is still some uncertainty, both politically and economically, it really does feel like we have moved away from the peak of interest rates, that people are done with sitting on the fence and are now ready to get on, when it comes to moving home.

Where there is a lot of evidence demonstrating the resilience of the UK property market, we must remember not to get carried away with this positive market activity and growth in prices. Whilst interest rates have continued to slip down, they are still significantly higher than what they have been in recent years. The average monthly mortgage payment is currently 38% higher than five years ago, and this coupled with a higher number of properties for sale, will limit capital growth.

WHAT WILL HAPPEN TO MORTAGE RATES?

The Bank of England Base Rate was held at 5% on 19th September, following a cut at the start of August from 5.25% – the first in more than four years. There are predictions that by Autumn 2025 the Base Rate could fall to 3.5%.

In May we saw the rate of inflation fall below the Bank of England’s target of 2% for the first time since 2021. The current inflation rate at time of writing this article is 1.7%.

The current average mortgage rate for a five-year fixed rate mortgage is 4.54%, down from 4.57% last week. The current average two-year fixed rate mortgage is 4.88%, down from 4.91% last week as well. Modest decreases, but decreases nevertheless.

The lowest available two-year fixed rate is currently 3.84% and the lowest available 5-year fixed rate mortgage is now 3.68%. A further cut to the Base Rate is forecasted to happen before year end. Keep your eyes peeled on the next two MPC meetings taking place 7th November and 19th December.

The outlook for interest rates is far from certain considering global events. Fixed mortgage rates today reflect the extent by which financial markets expect UK interest rates to lower in the next 2-5 years. Many commentators believe that mortgage rates will settle within the high 3% to low 4% range in 2025.

OTHER FACTORS IMPACTING BUYER DEMAND

Household incomes are rising which improves buyer affordability and positively influences buyer confidence.

Perhaps not discussed as much outside of the capital, but the exchange rate can have an impact on property prices. You might be surprised at just how many transactions happening locally involve overseas buyers or overseas funding. There are also many sellers that are leaving the UK and purchasing their next home abroad.

Now the elephant in the room – the Autumn Budget taking place 30th October. Much like elections, an impending budget causes some political and economic uncertainty, which the property market does not react too kindly to in the build up to the event.

We have analysed the number of mortgage approvals seen over the two months prior to, and then straight after the last ten budgets since March 2020. On average, the number of buyers entering the market increases by 10.6% following a major budget. The average boost to mortgage approval levels following a budget sits at 2.9%.

Historic data does show that market activity and property prices, more often than not, move in a positive direction following an election or major budget, and the recent election is evidence of that.

CASE STUDY

This property on Ragged Hall Lane in St. Albans, has been on and off the market since 2023 with several other agents, without any success identifying a suitable buyer.

Camden Chase listed the property in early September this year. After an open house with multiple buyer visits, a sale was agreed in excess of the asking price, within two weeks of launch.

Here is what the owner Paul had to say about his experience:

“Having used numerous local estate agents over the years for various property sales, I have to say that my recent experience of using Scott Henderson of Camden Chase to sell my property is night and day, compared to what I have experienced previously. I can’t recommend Scott highly enough. Scott offers a very professional, personal service and is very hands on and shows a level of ‘caring’ that I have not seen before. Thank you Scott for all your hard work”

CLICK THIS LINK TO SEE HOW WE MARKETED THE HOUSE. THE VIDEO IS A MUST WATCH!

WHAT DID WE DO DIFFERENTLY?

1. Professional photos and aerial photography highlighting the homes incredible presentation, the quality of the fixtures and fittings, and the 3,400sqft floor area. Whilst making sure to show off the 125ft garden.

2. Presenter-led video tours (including social media and YouTube advertising) demonstrating how the home is lived in to help build an emotional connection with buyers (which generates 6% more enquiries and helps homes sell 50% faster compared to a listings without video according to Rightmove)

3. The property was also marketed on a specific price bracket on Rightmove and Zoopla which gives the listing 11% more views, which in turn means more enquiries, more physical viewings and more offers.

THE VIP BUYERS CLUB

Another service we provide which helps us to sell properties that other agents can’t, is a pro-active property search service called “The VIP Buyers Club”. We effectively act as a matchmaker by identifying off-market (not advertised) opportunities to help buyers find their dream home.

Did you know that if you are currently looking to buy a property in Radlett by searching on Rightmove, you would only see roughly 2.5% of all the properties that are actually potentially available to you?

By using advanced technologies, we should be able to open the doors of at least one home that is not currently advertised, on Rightmove, Zoopla or anywhere else, for every buyer that benefits from the service. Sometimes we are able to introduce buyers to two or even three homes.

HOW TO INCREASE THE VALUE AND SALEABILITY OF YOUR PROPERTY

If you are currently on the market or you are looking to sell in the near future and want our advice on how to improve the value and saleability of your house, or if you are struggling to find your next home, please don’t hesitate to get in touch. We will be happy to give you the benefit of years of experience in selling homes for record prices and helping buyers find their dream home.

To end the year, we are helping St Albans homeowners plan for 2025 by conducting a complimentary initiative for a select group. I’m not sure if it’s for you, but we will be offering our expert opinion on the value of your home and and how to increase it. A meeting will only take only 30 minutes of your time.

The following information will be made available to you:

1. The current market value of your property – an equity update.

2. Instructions on how to increase the value and saleability of your property.

3. An in-depth professional report on the local property market.

4. Answers to any questions you might have about selling or the moving process.

Regardless of your timeline, we have found knowing the current value of your property can help you to plan for the future, with considerations for remortgaging, drawing equity for renovations, or using funds for things such as a deposit for an investment property. Whether you are looking to sell in the coming months or just curious as to the current value of your home, rest assured you won’t be wasting our time by getting in touch.

Thank you for taking the time to read the Q3 2024 Premium Property Market Update and we look forward to hearing from you soon.

If you’ve skipped to the end, in a nutshell; Q3 2024 saw a rebound in activity compared to last year with clear signs of buyer demand increasing. Despite political and economic uncertainty, sales activity is improving due to lowering interest rates.

However, it remains a very price sensitive market where only serious, realistic and flexible sellers presenting a competitively priced property, are attracting value-conscious buyers to take action.